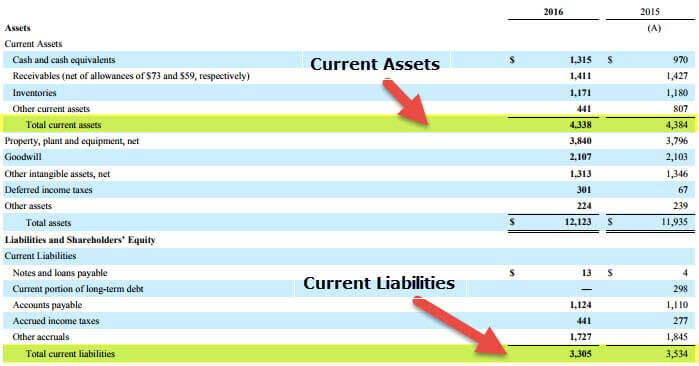

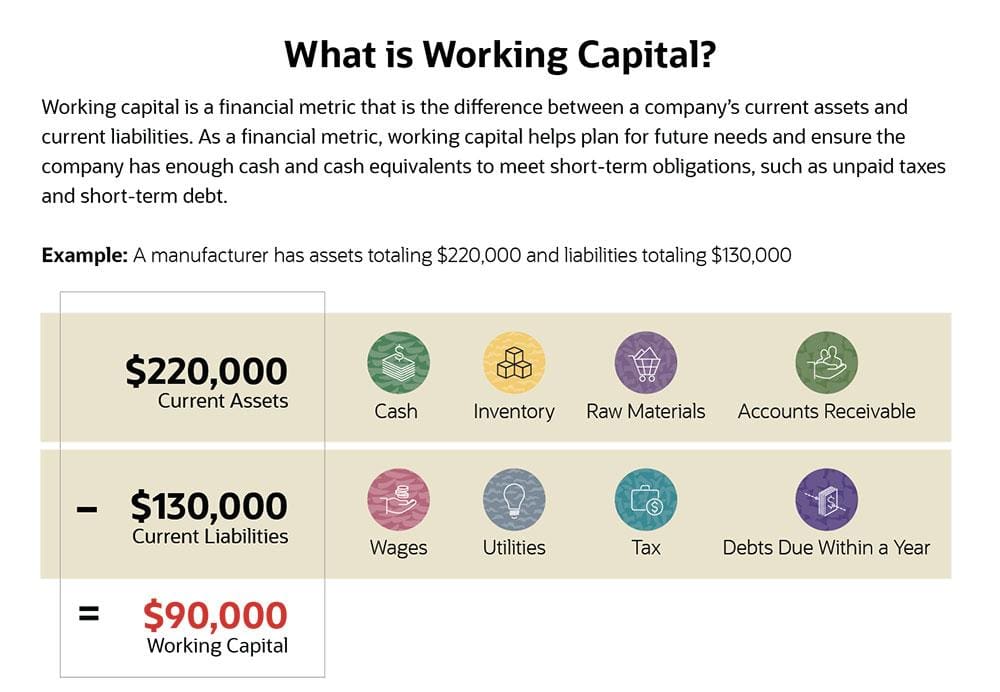

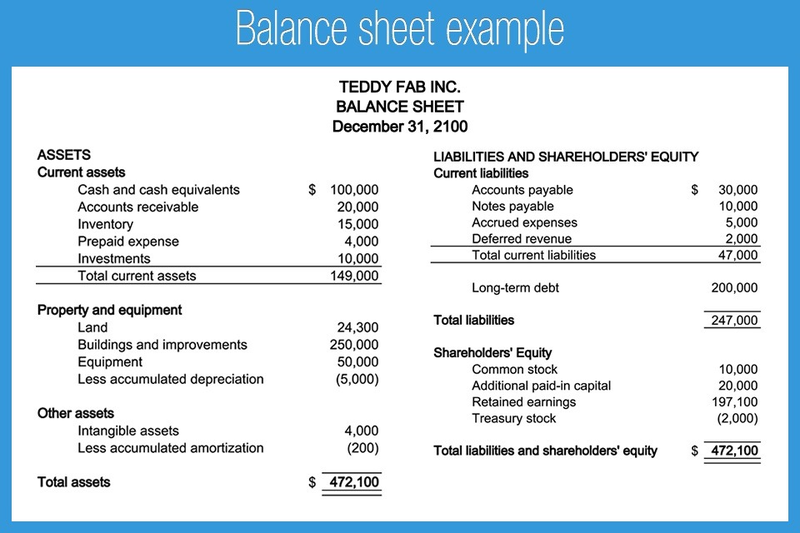

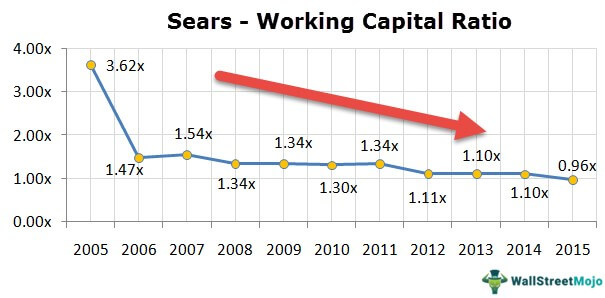

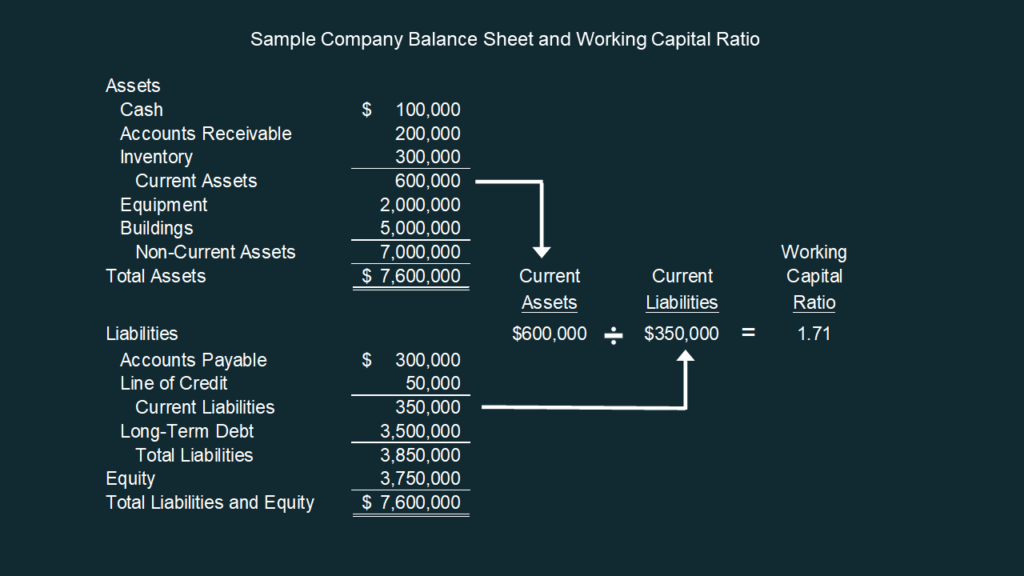

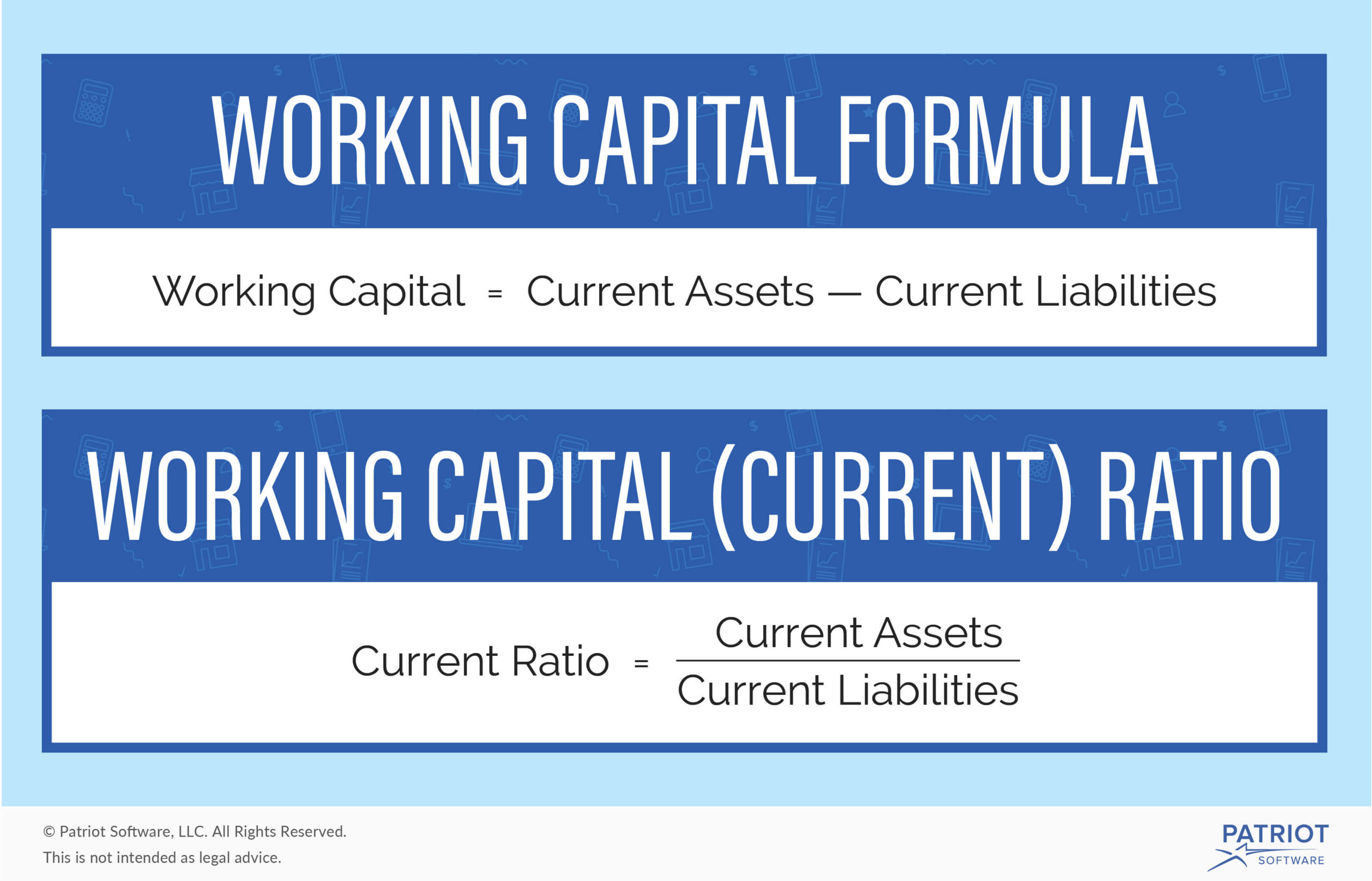

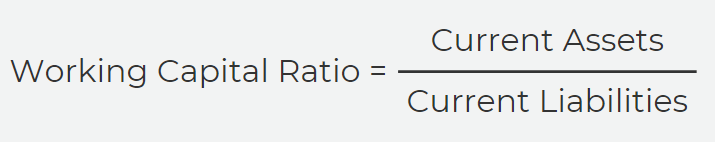

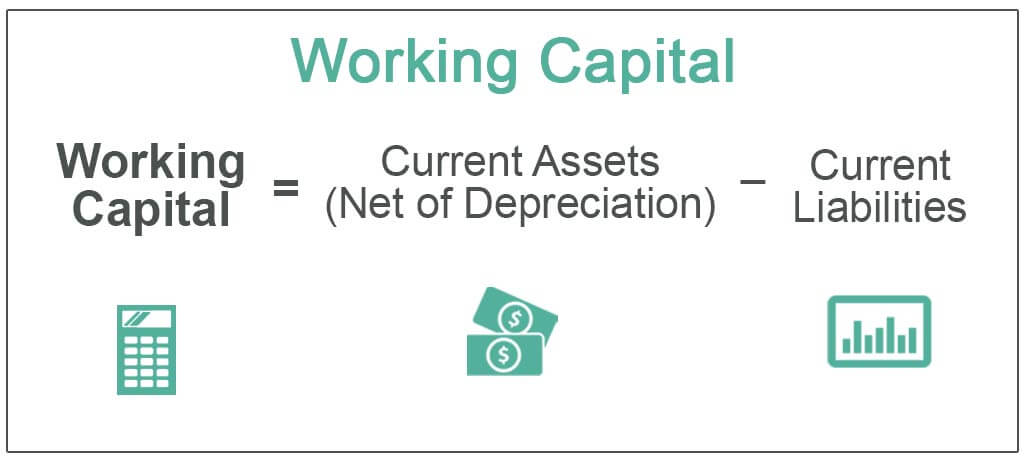

Net working capital (NWC) is current assets minus current liabilities It's a calculation that measures a business's shortterm liquidity and operational efficiency It's also important for predicting cash flow and debt requirements Net working capital is also known simply as "working capital" NWC is a way of measuring a company(or working capital) Level of Current Assets Determining the optimal level of current assets involves a tradeoff between costs that rise with current assets (carrying costs) and the costs that fall with current assets (shortage costs) Carrying costs areFormula The working capital ratio is calculated by dividing current assets by current liabilities Both of these current accounts are stated separately from their respective longterm accounts on the balance sheet This presentation gives investors and creditors more information to analyze about the company Current assets and liabilities are

Change In Working Capital Video Tutorial W Excel Download

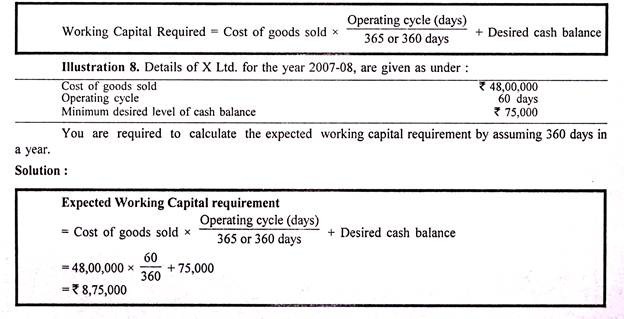

Level of working capital formula

Level of working capital formula-In this ratio working capital is defined as the level of investment in inventory and receivables less payables In exam questions you may have to assume that yearend working capital is representative of the average figure over the year The sales to working capital ratio indicates how efficiently working capital is being used to generate sales The Art of Negotiating Working Capital in M&A Transactions There are two major elements to the negotiations agreeing on the working capital target amount, and agreeing on the formula for calculating the actual working capital for the target, at closing and in the trueup Here are 6 key concepts for formulating a negotiating position

Working Capital Management Acca Global

Currents assets minus current liabilitie Working capital is a measure of both a company's efficiency and its shortterm financial health Working capital is calculated asOverall working capital policy considers both a firm's level of working capital investment and its financingIn practice, the firm has to determine the joint impact of these two decisions upon its profitability and riskHowever, to permit a better understanding of working capital policy, the working capital investment decision is discussed in this section, and the working capital

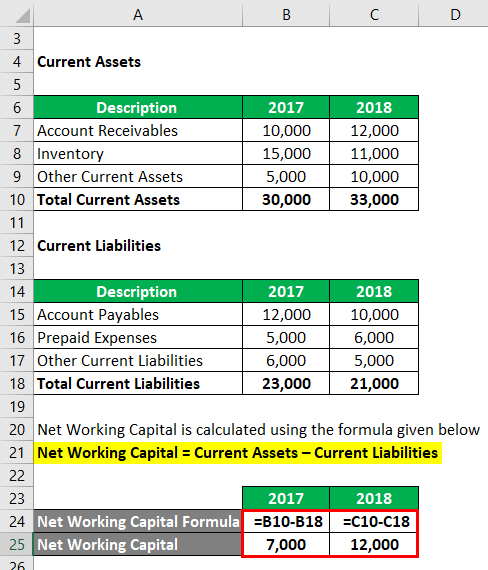

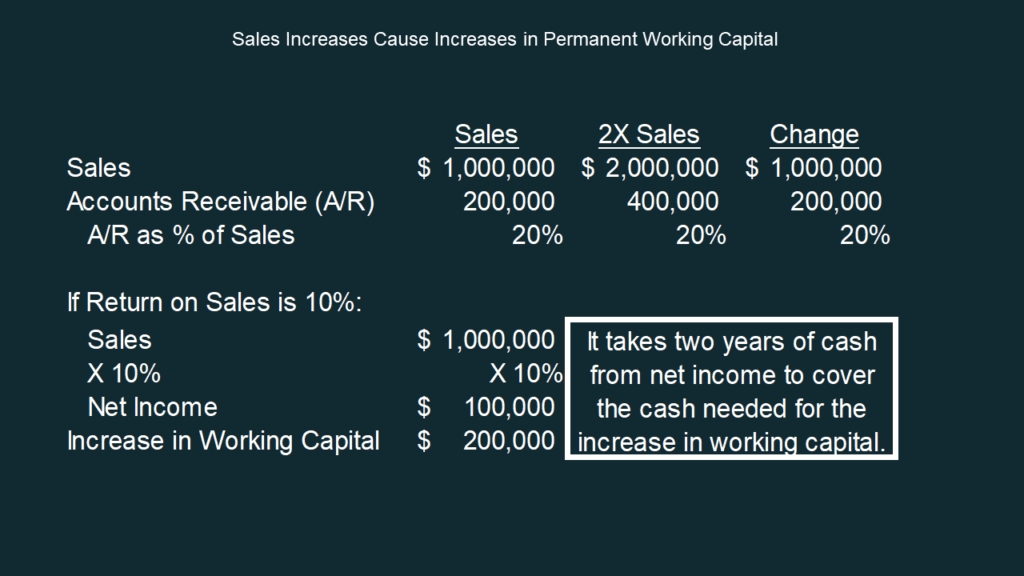

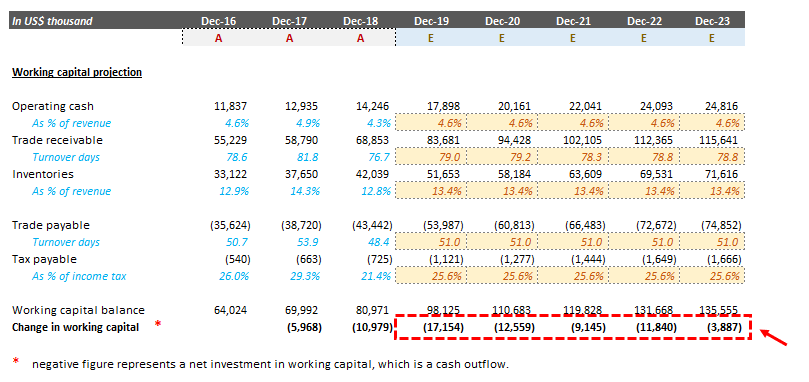

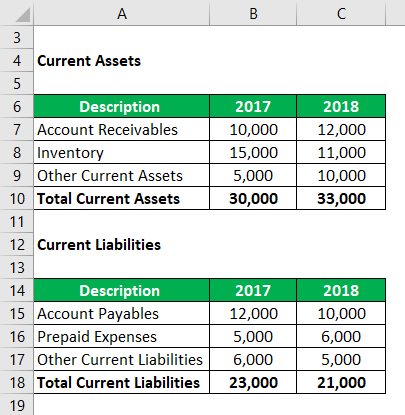

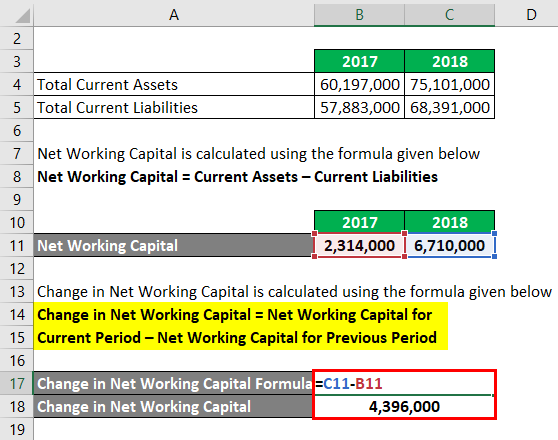

A company uses its working capital for its daily operations You can calculate the change in net working capital between two accounting periods to determine its effect on the company's cash flow An increase in net working capital reduces a company's cash flow because the cash cannot be used for other purposes while it is tied up in working The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales Working capital is current assets minus current liabilities A high turnover ratio indicates that management is being extremely efficient in using a firm's shortterm assets and liabilities to support sales The formula is How to Interpret Working Capital Under the best circumstances, insufficient working capital levels can lead to financial pressures on a company, which will increase its borrowing and the number of late payments made to creditors and vendors

Into account in the working capital analysis (for example, deferred revenue or liability reserves) As part of the working capital adjustment, it is necessary to calculate a target working capital This represents the normalised level of working capital of the target business before the closing, on which the parties have agreed It also representsUnderstanding Working Capital Targets in M&A Transactions We have found that net working capital ("NWC") targets are one of the most commonly misunderstood components of M&A deals While sometimes confusing, we believe sellers need to understand the logic behind NWC targets, as it can often become one of the more heavily negotiated itemsNet working capital – this is what people generally mean when they talk about working capital;

1

What Is Net Working Capital How To Calculator Nwc Formula

Negotiating working capital is one of the most contentious issues in closing a deal That's because determining the amount of sufficient working capital needed to fund ongoing business is a complicated exercise Robert B Moore, Partner, McGladrey LLP, has expertly summarized the issues is his white paper, "Negotiating Working Capital Targets and Definitions" Example Working capital cycle Let us understand the working capital cycle based on information from two companies Company A has a working capital cycle of negative 85 days The business receives inventory on day 1 and sellsThe working capital formula tells us the shortterm liquid assets available after shortterm liabilities have been paid off It is a measure of a company's shortterm liquidity and is important for performing financial analysis, financial modeling What is Financial Modeling Financial modeling is performed in Excel to forecast a company's

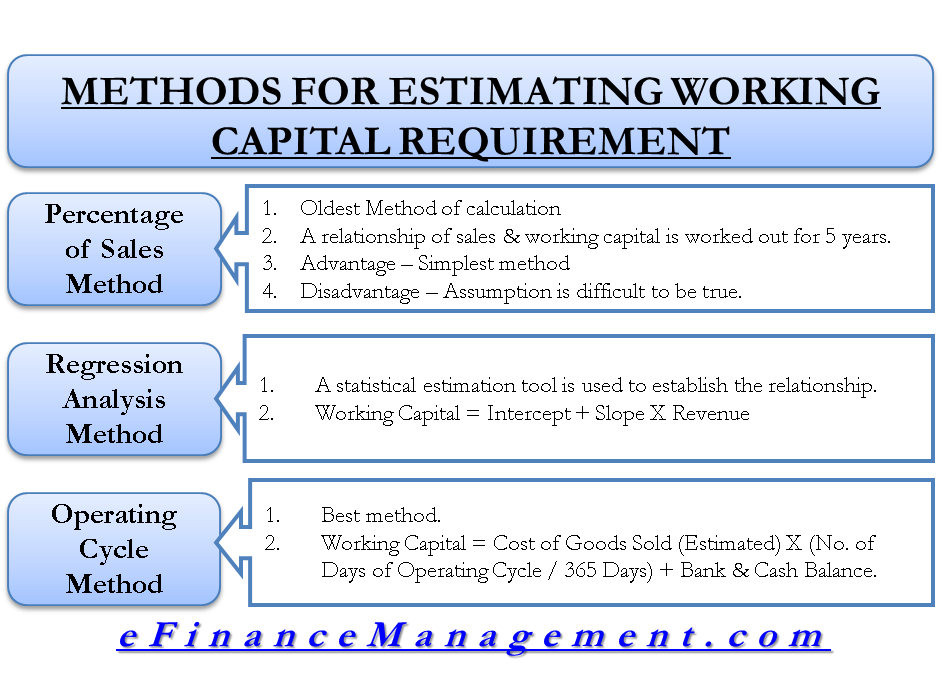

Methods For Estimating Working Capital Requirement

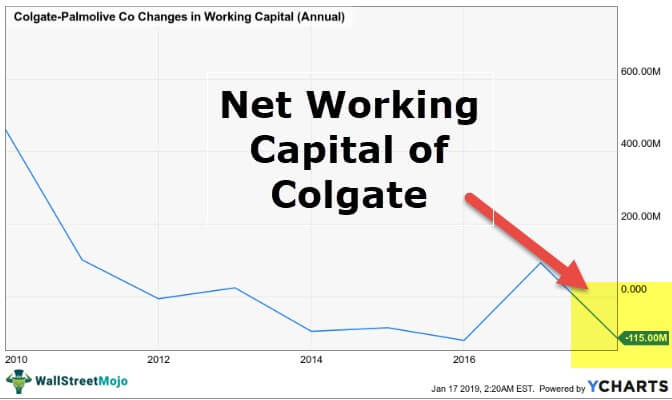

Changes In Net Working Capital Step By Step Calculation

The Usefulness of Working Capital Many entrepreneurs believe that capital is one of the most useful figures that can be extracted from a balance sheet Understanding the meaning of working capital can help your company make important decisions such as How to adjust your level of capital use in response to changes in your business cycle Working Capital is an essential metric in financial analysis, as it shows creditors and potential investors if the company can pay its shortterm payables within one yearThat includes sufficient working capital to operate the business at its current levels If they grow the business and additional working capital is required they will provide it At Sunbelt we use a methodology that generally bridges the gap in calculations done by the buyer and the seller and is the accepted practice within experienced

Working Capital Examples Top 4 Examples With Analysis

Working Capital Definition Formula Examples With Calculations

"Working capital" is the money you need to support shortterm operations It is this focus on the short term that distinguishes working capital from longerterm investments in fixed assets or R&D Working capital is the difference between current assets and current liabilities "Current" again refers to the fact that these items fluctuate in the short term,You can get a sense of where you stand right now by determining your working capital ratio, a measurement of your company's shortterm financial health Working capital formula Current assets / Current liabilities = Working capital ratio; How is net working capital determined?

Working Capital Example Formula Wall Street Prep

Working Capital What It Is And How To Calculate It Efficy

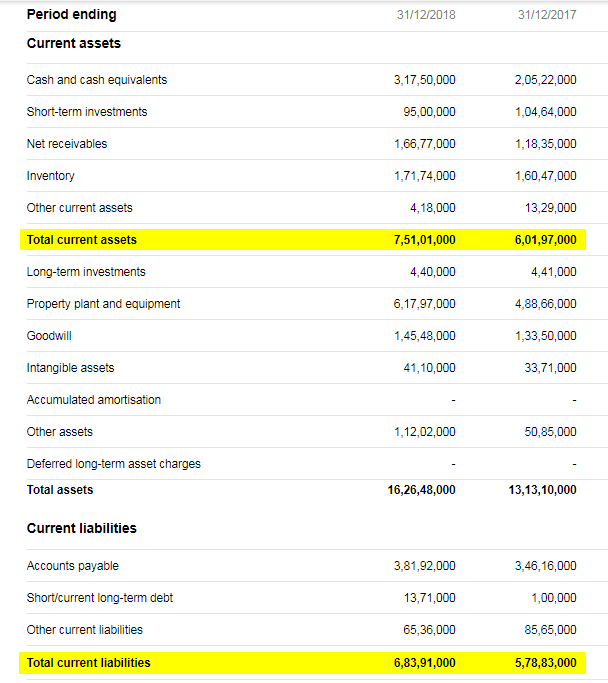

Calculating the Acceptable Level of Working Capital Cash and cash flow are critical to the health and viability of any company When companies generate sufficient cash flow from operations toWorking Capital (Net Current Assets) By adding together the totals for current assets and current liabilities in the balance sheet, a very important figure can be calculated – working capital Working capital provides a strong indication of a business' ability to pay is debts Every business needs to be able to maintain daytoday cash flowThe normal level of working capital is an amount defined in the purchase agreement and referred to as a net working capital target, a net working capital peg or net working capital true up The required level of working capital is generally calculated as the average of the last twelve months ( LTM ) By taking twelve months any seasonality

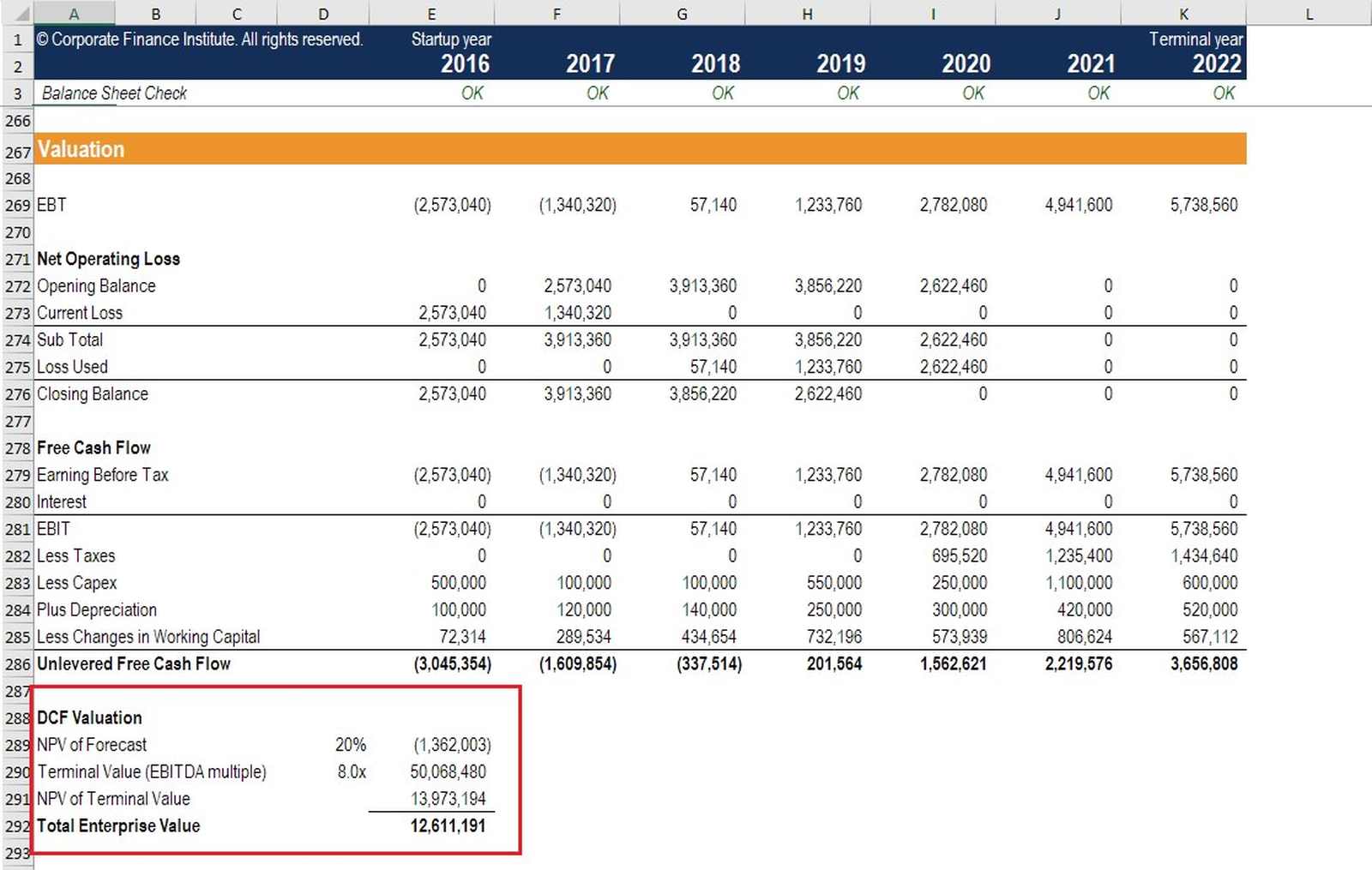

Working Capital In Valuation

What Is Meaning Of Capital Turnover Ratio Newyork City Voices

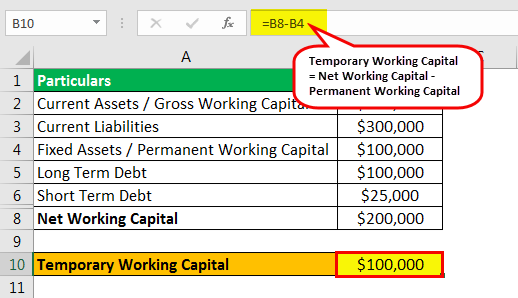

What is working capital? Permanent working capital is the minimum investment required in working capital irrespective of any fluctuation in business activity Also known as fixed working capital, it is that level of net working capital below which it has never gone on any day in the financial year Net working capital (NWC) means current assets less current liabilities This term is important to beTo determine what a "normal" level is for NWC, an average of the previous six to 12 months is often used, which may be referred to as the "target" or "peg" At closing, the actual NWC delivered is compared to an agreedupon target and a "trueup" then occurs

Net Working Capital Formula Example Calculation Ratio

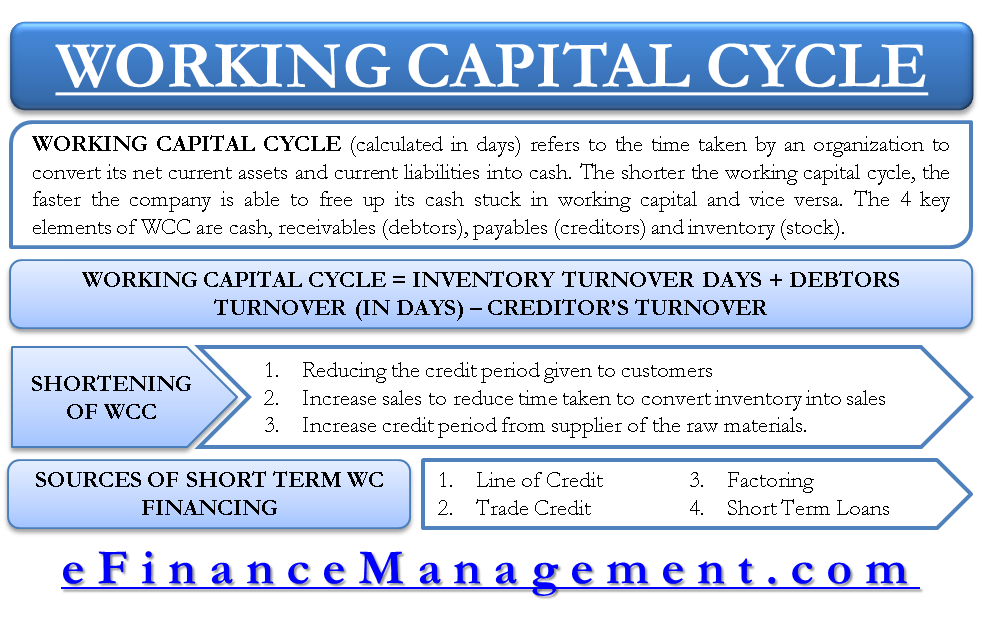

Working Capital Cycle Understanding The Working Capital Cycle

Net working capital is an important component to any transaction Gaining a comprehensive understanding of net working capital provides buyers the level of cash required to operate the business post transaction close, thereby avoiding unanticipated additional cash infusionSales to working capital ratio is a liquidity and activity ratio that shows the amount of sales revenue generated by investing one dollar of working capital Assets, also called working capital, represent items closely tied to sales, and each item will directly affect the resultsThe following tables illustrate typical working capital trends seen in these categories Working capital amounts can be small at one company and quite significant at another Looking at working capital as part of the total deal or in relation to sales, can show that it varies in importance from company to company

Change In Net Working Capital Formula Calculator Excel Template

/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)

What Is Working Capital

If you have current assets of $1 million and current liabilities of $500,000, your working capital ratioWorking Capital Ratios (liquidity) • The "liquidity position" of a business refers to its ability to pay its debts – ie does it have enough cash to pay the bills?Cash Current assets divided by current liabilities is known as a working capital ratio To calculate a company's average working capital, the following formula is used (Working capital of the current year Working capital of the prior year) ÷ 2 This indicates whether a company possesses enough shortterm assets to cover shortterm debt

What Is Net Working Capital How To Calculate Nwc Formula

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

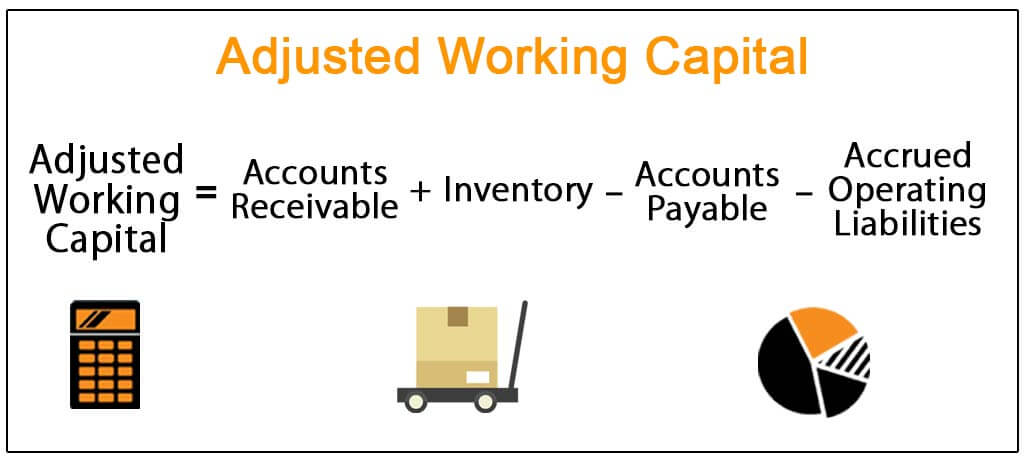

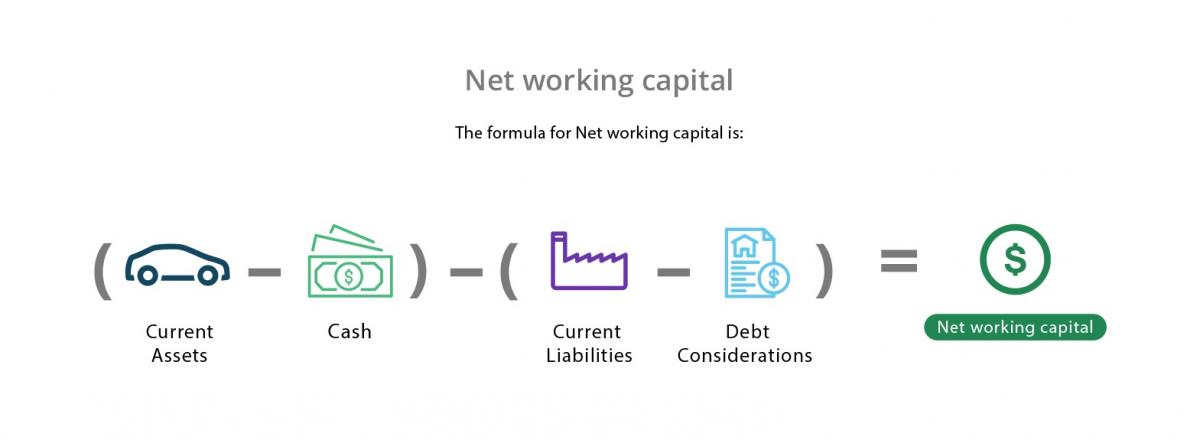

Working capital adjustments are required when a going concern business is acquired by way of a share purchase This is the case for two main reasons (i), because working capital changes every day as revenues are generated and supplier and payroll payments are made, and (ii), because working capital is easily manipulated in a material way (for example, the seller could withdraw Formula Net Working Capital = Current Assets (less cash) – Current Liabilities (less debt) or, NWC = Accounts Receivable Inventory – Accounts Payable The first formula above is the broadest (as it includes all accounts), the second formula is more narrow, and the last formula is the most narrow (as it only includes three accounts) Working capital is a snapshot of a present situation, while cash flow measures the ability to generate cash over a specific period Most businesses with high cash flow will also have high working capital But there can be some divergence depending on things like investments, paying off old debt and paying dividends to shareholders

Change In Net Working Capital Formula Calculator Excel Template

Operating Working Capital Owc Financial Edge

Working capital is calculated by subtracting current liabilities from current assetsIt is used in several ratios to estimate the overall liquidity of a business; Operating working capital needs to be kept as low as possible, even down into negative values, in order to improve the cash position To control the stock level, the purchasing volume needs be fine tuned to the latest sales trend and forecast How to calculate working capital Working capital formulaPostclosing or calculation disputes Such a formula would assign a certain percentage credit to the working capital depending on the aging schedule for the receivables For example, all receivables less than 30 days old would receive 90% credit in working capital, 3060 day receivables would be credited 75%, 6090 day

Net Working Capital Guide Examples And Impact On Cash Flow

What Is The Working Capital Formula Revenued

Excess working capital carries the 'carrying cost' or 'interest cost' on the capital lying unutilized Shortage of working capital carries 'shortage cost' which include disturbance in production plan, loss in revenue etc Finding the optimum level of working capital is the main goal or winning situation for any business managerThat is, the ability to meet obligations when due At a high level, the calculation of working capital is as follows Current assets Current liabilities = Working capital Change in Net Working Capital = 12,000 – 7,000 Change in Net Working Capital = 5,000 Since the change in net working capital has increased, it means that change in current assets is more than a change in current liabilities So current assets have increased It means that the company has spent money to purchase those assets

Working Capital Example Formula Wall Street Prep

Net Working Capital Formula Calculator Excel Template

Such an optimal level of Net Working Capital ensures that your business is neither running out of funds Nor, it is keeping its cash idle Changes in the Net Working Capital Formula Changes in the Net Working Capital = Net Working Capital of the Current Year – Net Working Capital of the Previous Year orInventory to working capital is a liquidity ratio that measures the amount of working capital that is tied up in inventory The difference between total current assets and total current liabilities is known as working capital or net working capitalWorking capital• The balance sheet of a business provides a "snapshot" of the working capital position at a particular point in time

Working Capital Management Acca Global

Change In Net Working Capital Formula Calculator Excel Template

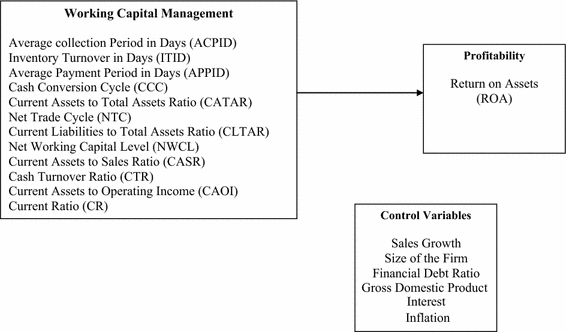

The level of working capital affects the degree of risk and profitability both Hence the level of working capital should be so fixed that, on the one hand, its financial soundness is maintained and on the other hand, its profitability is optimized At this point it is necessary to be clear about the meaning of solvency or insolvency of the firm

/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)

What Is Working Capital

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

What Is Working Capital How To Calculate And Why It S Important Netsuite

The Determinants Of Working Capital Management And Firms Performance Of Textile Sector In Pakistan Springerlink

Working Capital Formula Calculator Excel Template

Net Working Capital Formulas Examples And How To Improve It

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Working Capital Ratio Formula Examples Calculation Youtube

How To Understand A Company S Working Capital Position Investors Chronicle

Working Capital Example Formula Wall Street Prep

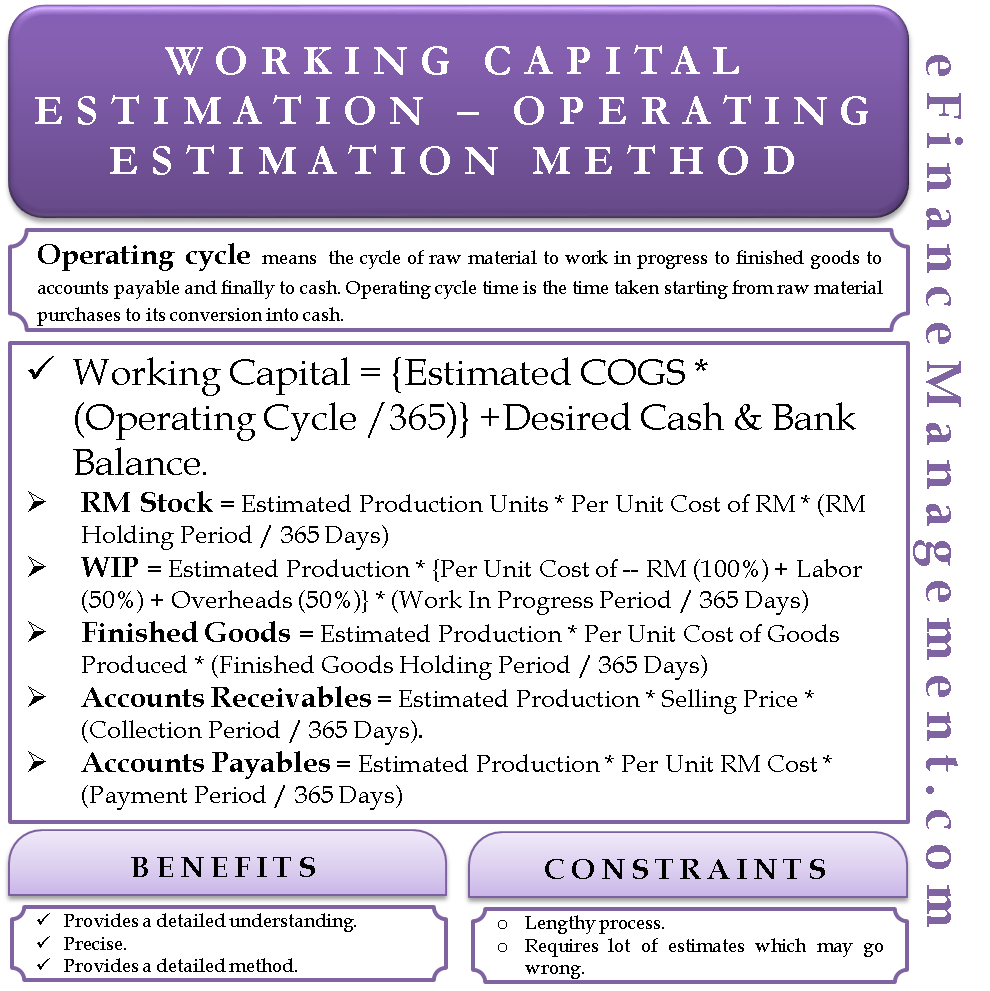

Working Capital Estimation Operating Cycle Method

Working Capital Formula How To Calculate Working Capital

Change In Net Working Capital Formula Calculator Excel Template

Working Capital Management Acca Global

Treasury Essentials The Cash Conversion Cycle The Association Of Corporate Treasurers

Working Capital Definition Elements Formula Calculation Example Cycle

17 Level I Cfa Corporate Finance Working Capital Summary Youtube

Change In Working Capital Video Tutorial W Excel Download

Net Working Capital Guide Examples And Impact On Cash Flow

Working Capital Formula How To Calculate Working Capital

How To Calculate Working Capital The Working Capital Formula

Working Capital Formulas And Why You Should Know Them Fundbox

Advanced Investment Appraisal F9 Financial Management Acca Qualification Students Acca Global

How To Calculate Working Capital Requirement Plan Projections

A Small Business Guide To Calculating Net Working Capital The Blueprint

Working Capital Management Businance

Working Capital Management Businance

Working Capital Management Acca Global

How To Calculate Working Capital With Calculator Wikihow

Working Capital Financial Edge

Working Capital And Liquidity Explanation Accountingcoach

3

How To Calculate Working Capital Guide Formula Examples

/GettyImages-923217650-fc950a3a87ee4f4d88bddcaf949f617c.jpg)

How Do You Calculate Working Capital

What Is The Working Capital Cycle Touch Financial

Working Capital Financial Edge

Adjusted Working Capital Definition Formula Example

Acca F9 3 Working Capital Management Youtube

Change In Net Working Capital Formula Calculator Excel Template

Working Capital Example Formula Wall Street Prep

Working Capital Management Estimation And Calculation Taxmann Blog

Working Capital Ratio Definition Formula How To Calculate

Working Capital Cycle

:max_bytes(150000):strip_icc()/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)

What Changes In Working Capital Impact Cash Flow

:max_bytes(150000):strip_icc()/workingcapital-7044a3fc24ff4cb48cddab89700ee12d.jpg)

What Is Working Capital

Net Working Capital Formulas Examples And How To Improve It

Working Capital Formula How To Calculate Working Capital

How To Calculate Working Capital The Working Capital Formula

Change In Working Capital Video Tutorial W Excel Download

Cfa Level I Working Capital Management Part I Youtube

Changes In Working Capital Fcf And Owner Earnings

Working Capital Management Businance

How To Calculate Working Capital With Calculator Wikihow

Change In Net Working Capital Formula Calculator Excel Template

Assessment And Computation Of Working Capital Requirement

:max_bytes(150000):strip_icc()/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)

Working Capital Definition

Working Capital Example Meaning Investinganswers

How To Calculate Working Capital With Calculator Wikihow

The Ins And Outs Of Business Working Capital Calculation Examples

Working Capital

How To Calculate Working Capital With Calculator Wikihow

Net Working Capital Guide Examples And Impact On Cash Flow

Working Capital What Is It And Why It S Important

1

How To Calculate Working Capital With Calculator Wikihow

1

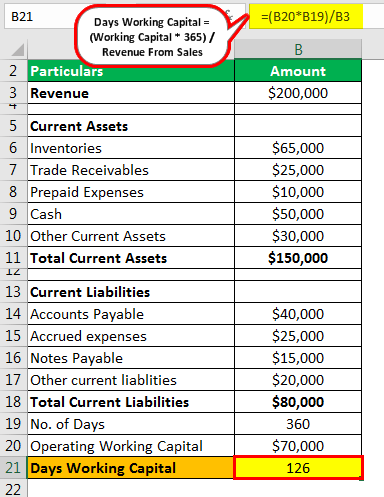

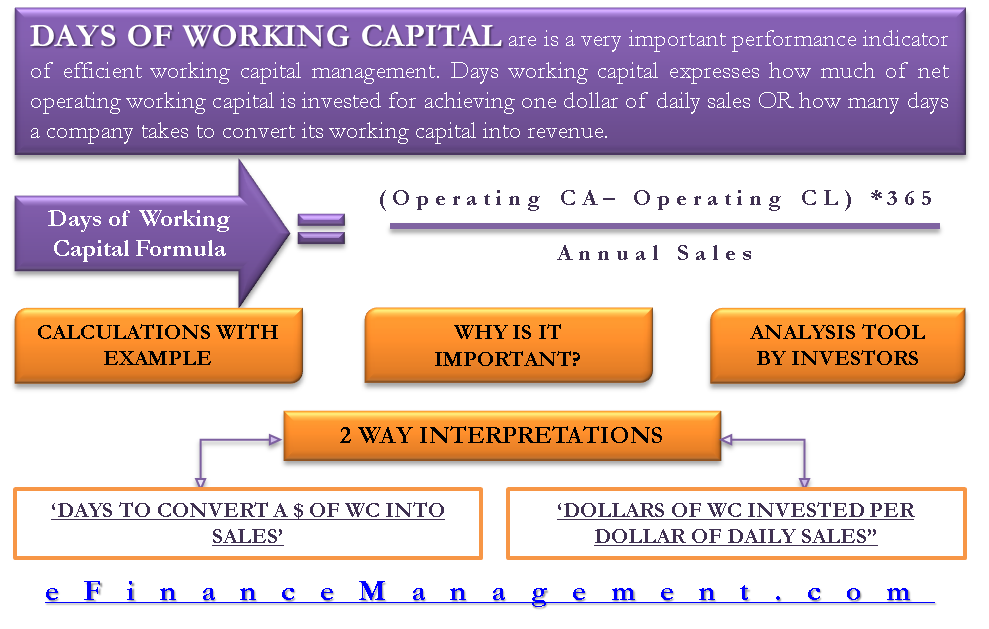

Days Working Capital Definition Formula How To Calculate

Working Capital Example Formula Wall Street Prep

Back To Basics Working Capital Workful

Working Capital Turnover Ratio Meaning Formula Calculation

How To Calculate Working Capital Requirement Plan Projections

Working Capital Definition Formula Examples With Calculations

Change In Working Capital Video Tutorial W Excel Download

How To Calculate Working Capital With Calculator Wikihow

Working Capital What It Is And How To Calculate It Efficy

Days Working Capital Formula Calculate Example Investor S Analysis

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Net Current Assets Tutor2u

Working Capital Example Formula Wall Street Prep

Days Working Capital Definition

0 件のコメント:

コメントを投稿