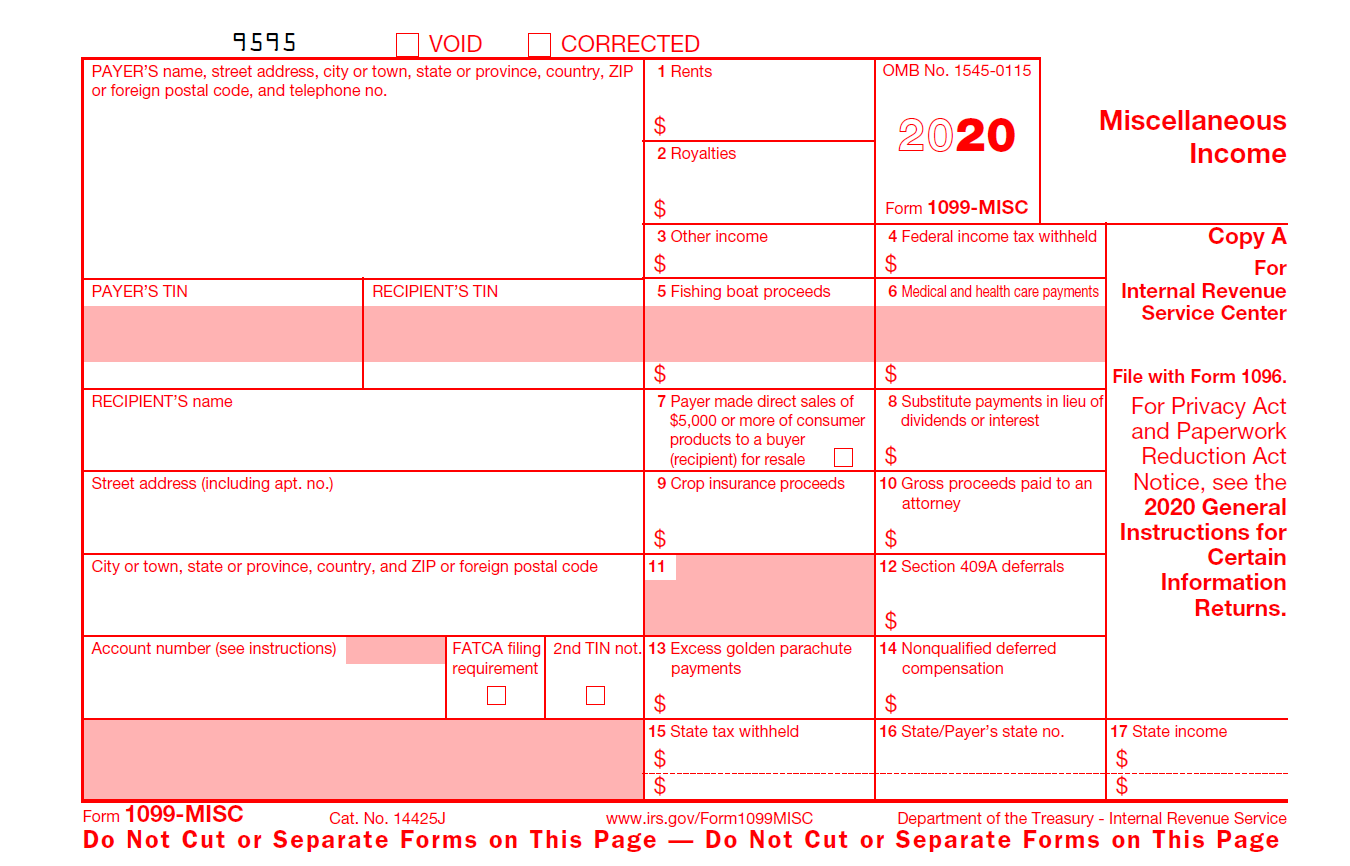

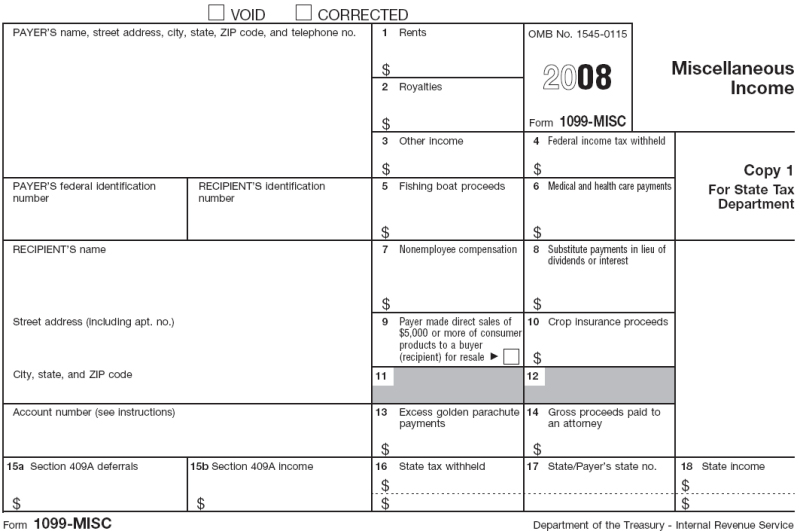

Form 1099 Step by Step Instructions on how to efile the Form 1099 is Taxable Income on your or 21 Tax Return May 17 is Due Date Form 1099 Reported Online to the IRS by the Payer or Issuer Issue a Form 1099 to a Payee, Contractor or the IRSForm 1099 is utilized to report certain kinds of income earned outside of employment to the IRS like dividends from a stock or a payment you received as an independent contractor Businesses are required to issue 1099s to any payee (other other than a corporation ) who receives at least 600 dollars during the calendar year Form 1099A is a form issued by a bank or other financial institution to a person who has made a deposit or withdrawal from the institution The form must be filed with the Internal Revenue Service (IRS) by the institution The form reports the total amount the taxpayer deposited or withdrew and the date of the transaction Form 1099A is also known as a reconciliation

1099 Software 1099 Printing Software 1099 Efile Software And 1099 Forms Software

Printable independent contractor 1099 form

Printable independent contractor 1099 form-For certain types of income other than employment, Form 1099 could be used to submit to the IRS dividends from stocks , or payments you receive as an independent contractor Businesses must issue 1099s to anyone who pays (other than a company ) thatThe taxpayers are supposed to send 1099 MISC Forms to the contractors by February 1st, 21 Submit your Form 1099 online to the IRS by March 31st, 21 There are late penalties for payer's who file the information returns late As an independent contractor, you should file

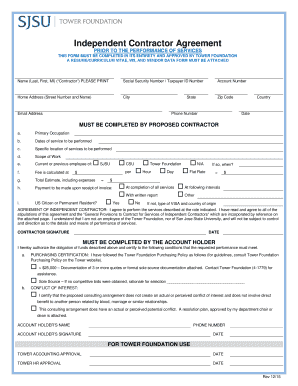

Www Schooltheatre Org Higherlogic System Downloaddocumentfile Ashx Documentfilekey C6a7e1c1 4254 5765 61a8 7621c Forcedialog 0

Here are a few tips and printable 1099 form instructions on handling your 1099(s) like a pro go through your work in order to make sure you have all the necessary details on the freelancers you've worked with;Form is also useful for freelancers and independent contractors who are looking to make a tax statement 1099 forms to print helps freelancers, independent contractors, and other businesses to determine how much tax they are required to pay at the end of the year IRS requires that freelancers file their taxes using the document Independent contractor 1099 invoice template If the 1099 independent contractor contracts an infectious or debilitating disease, they could sue for medical costs We use adobe acrobat pdf files as a means to electronically provide forms & publications Fillable 1099 form independent contractor Fill in blank printable invoice;

Tax Worksheet for Selfemployed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099MISC with box 7 income listed Try your best to fill this out If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rateThe 1099 MISC form is indented for your use in case you are an independent contractor or a freelancer It is necessary to report income, other than wages salaries and tips to the IRS Rental property income, earnings from interest and dividends, sales proceeds and other miscellaneous revenue may be includedGet your 1099 MISC printable template (we will easily help you with that here at our website) print 1099 form or complete it online

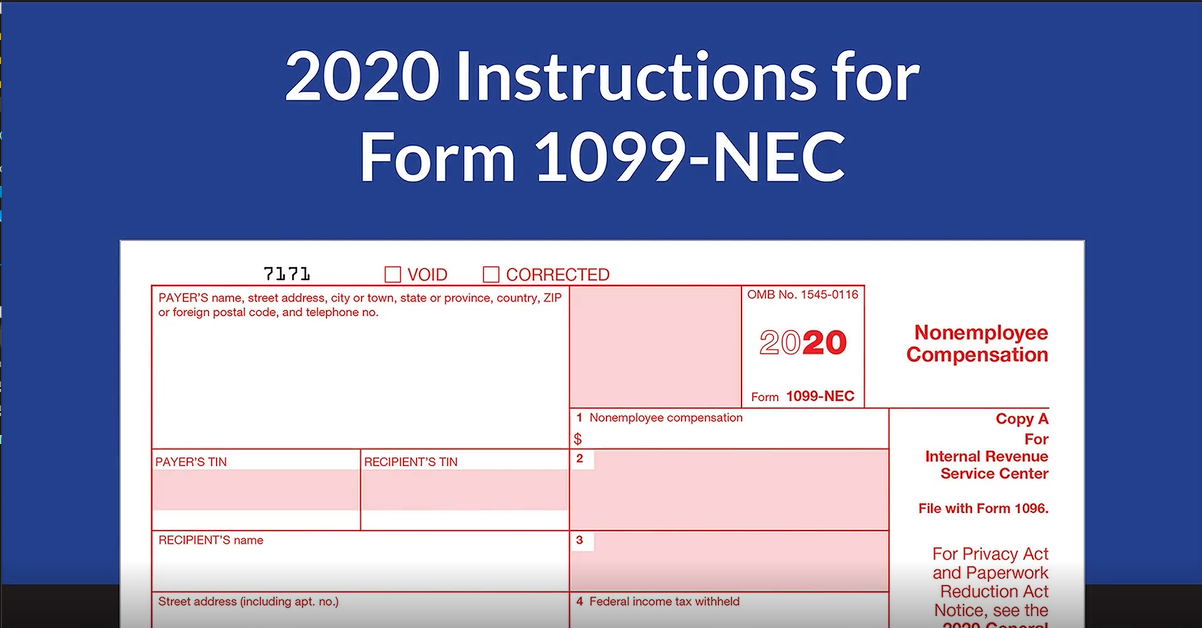

Now we need to print the 1099 form (print form 1099 MISC) Click on the print button, this will bring up the 1099 print dialog, where you can select the different 1099 printing settings and options Step 6 Select one or more 1099 form recipients you want to print the 1099 form (s) forTax form 1099 is generally used to report payments to nonemployees, such as independent contractors and freelancers It may also be used to show other kinds of payments, such as rental income or standby charges for a VOD payment Printable form 1099 blank should not be used to report wages paid to employeesWhat is a Form 1099NEC independent contractor?

1099 Misc Form Fillable Printable Download Free Instructions

Understanding Taxes Tax Tutorial Payroll Taxes And Federal Income Tax Withholding

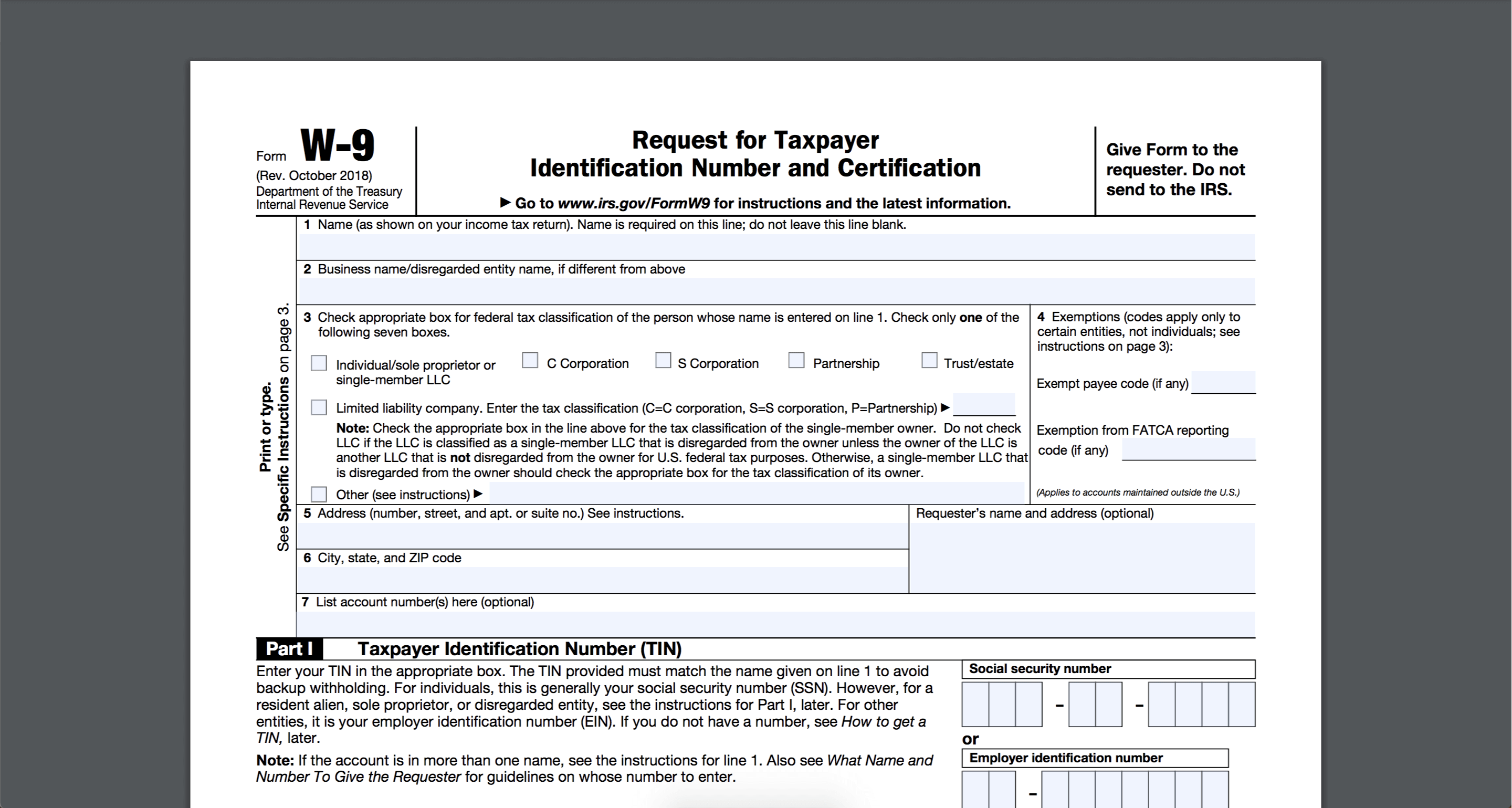

1099 Misc 21 Pdffiller The 1099 form is used to report certain kinds of income that a taxpayer has earned throughout the year It's used to New Printable Form & Letter for 21 Print 1099 Misc forms Free Unique Printable 1099 Tax form Examples 1099 Form 19 ð Get 1099 MISC Printable Form Instructions Example Printable 1099 Forms For Independent Contractors Model 1099 Form 19 ð Get 1099 MISC Printable Form Instructions Picture Nonstandard Approach to Gravity for the Dark Sector of the Simple, Printable Form 1099Blank Printable W9 – Form W9Request for Taxpayer Identification Number and Certification — is a commonly used IRS form If you have your own business or operate as an independent contractor a client may request that you fill out and mail a W9 so they can precisely prepare the 1099NEC form and report the payments you make at the end of the year

Www Irs Gov Pub Irs Pdf F1099msc Pdf

Klauuuudia 1099 Misc Template

Printable 1099 Form 21 – The forms for 1099 report specific kinds of earnings that a tax payer earns during the calendar year It's used for tracking the nonemployment income Cash dividends, whether they're paid to own a stock, or interest generated from IRS 1099 Forms – In the event you have carried out any freelance work or other independent contractor work, you may get a 1099 Form from businesses that you simply have labored with more than the years (most probably a 1099MISC) 1099MISC Forms report to the Internal Revenue Service, exactly just how much a business has paid to you in the past year being an impartial contractor Printable 1099 Form 15 Timizconceptzmusicco For 15 Printable 1099 Tax Form Form Ssa 1099 Bogasgardenstagingco Throughout Form Ssa 1099 Pay Stub Create & Download For Free Formswift With Independent Contractor Pay Stub Template

How To Fill Out A 1099 Misc Form

Trucking Company Guide To Filing W2 And 1099 Forms Discount Tax Forms

1099 form independent contractor 21 Fill out documents electronically utilizing PDF or Word format Make them reusable by creating templates, include and fill out fillable fields Approve forms with a lawful electronic signature and share them via email, fax or print them out download forms on your PC or mobile deviceFollow these steps to properly prepare for completing your printable 1099 tax form 19 Collect the required information about each independent contractor you hired during the last year Access your 1099 tax forms printable at our website Print the templates out or fill the forms online without having to do it manually1099 form independent contractor 21 Fill out forms electronically using PDF or Word format Make them reusable by making templates, include and complete fillable fields Approve documents by using a lawful electronic signature and share them via email, fax or print them out Save files on your laptop or mobile device

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Form 1099 K Wikipedia

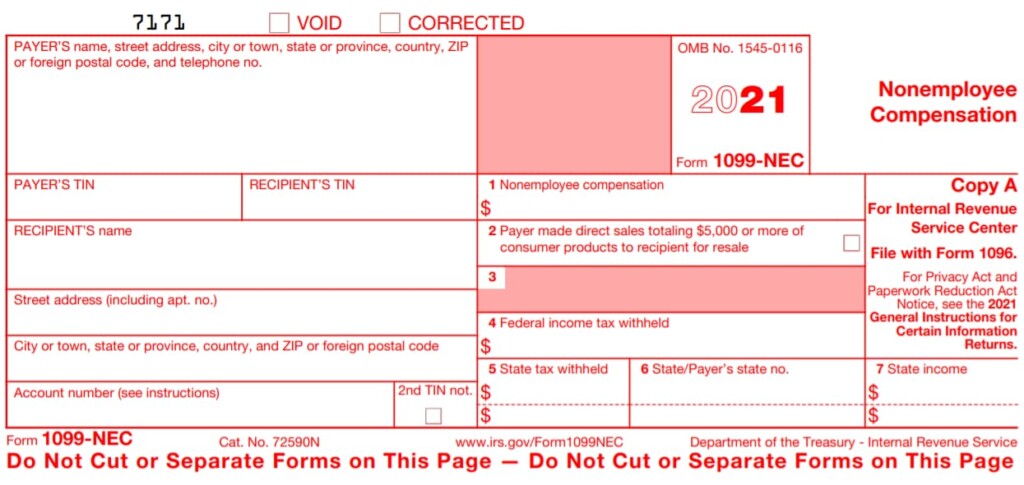

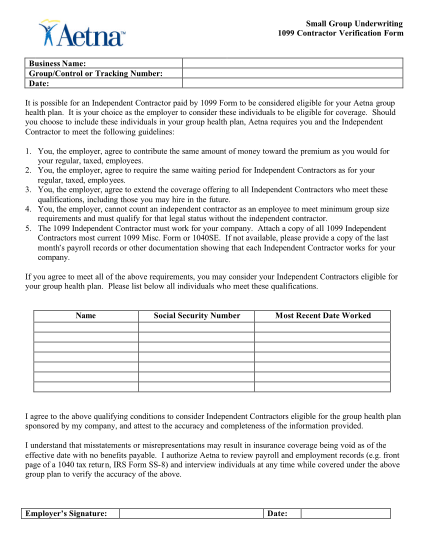

A To file the Form 1099MISC, you'll need a Form W9 and a Tax Identification Number (TIN) for each independent contractor The contractor provides you the Form W9 You should have every contractor fill out this document before services are provided This will ensure you have the information you need to fileIf you hire an independent contractor, you will be required to fill out a Form 1099NEC if you pay them more than $600 within a year The 1099NEC is needed to report how much income an independent contractor earns in a year You must send all completed 1099 forms to the IRS before January 31 of the following yearAmong the numerous tax forms, the IRS will be expecting you to fill out a 1099MISC form in two casesyou made payments to freelancers or independent contractors for businessrelated services totaling at least $600 within the year;or you paid minimum $10 in royalties or broker payments in lieu of dividends or taxexempt interestHowever, if you

Do Contractors Get 1099s

What Is The Account Number On A 1099 Misc Form Workful

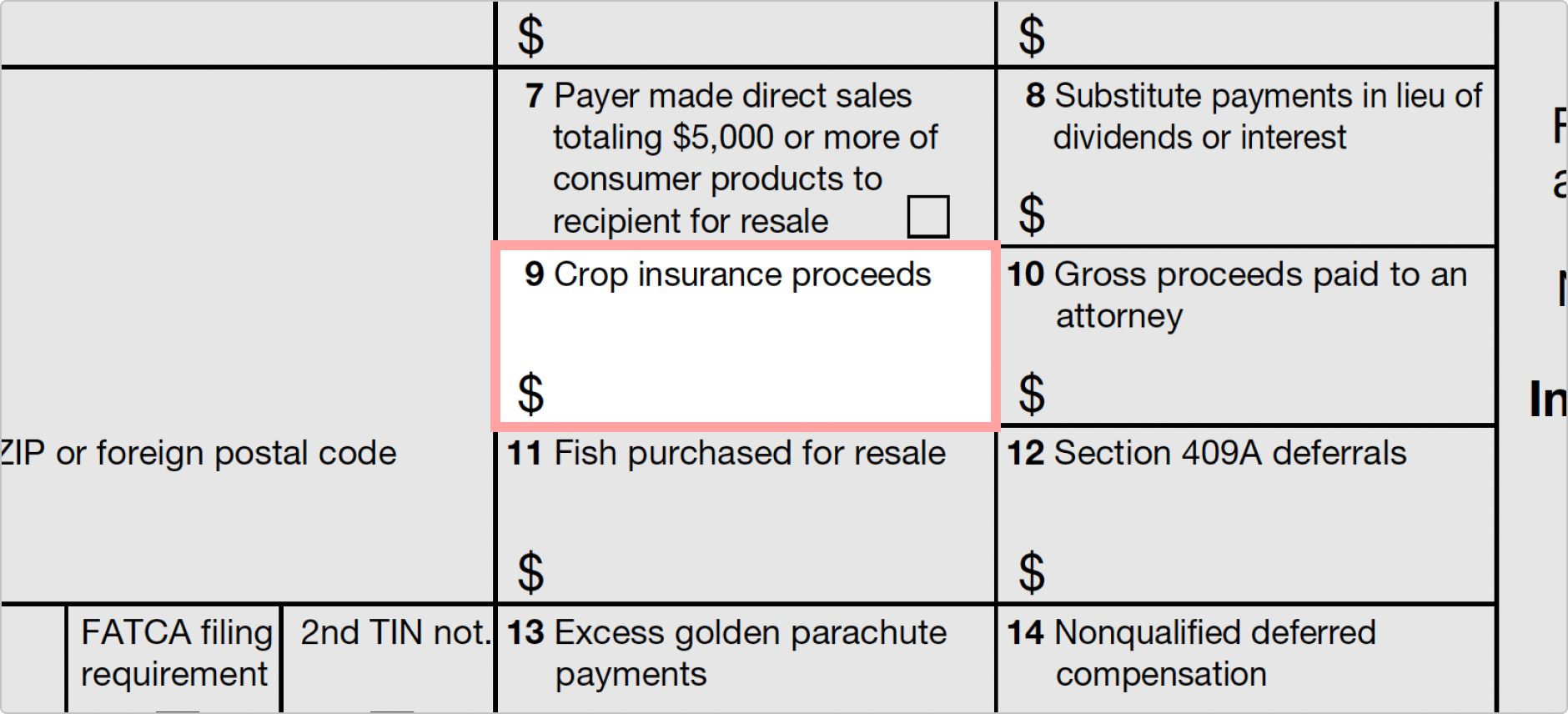

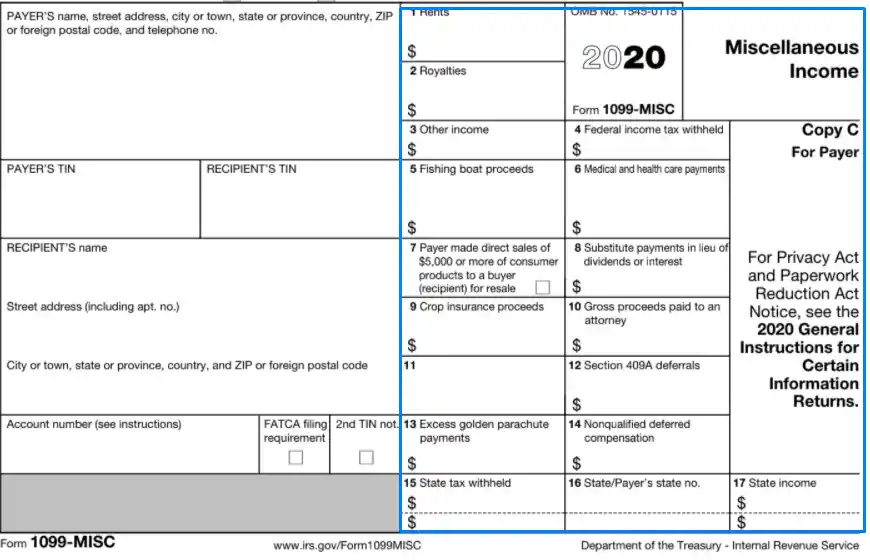

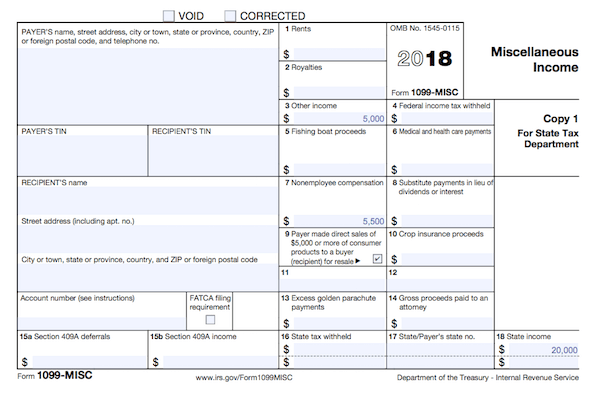

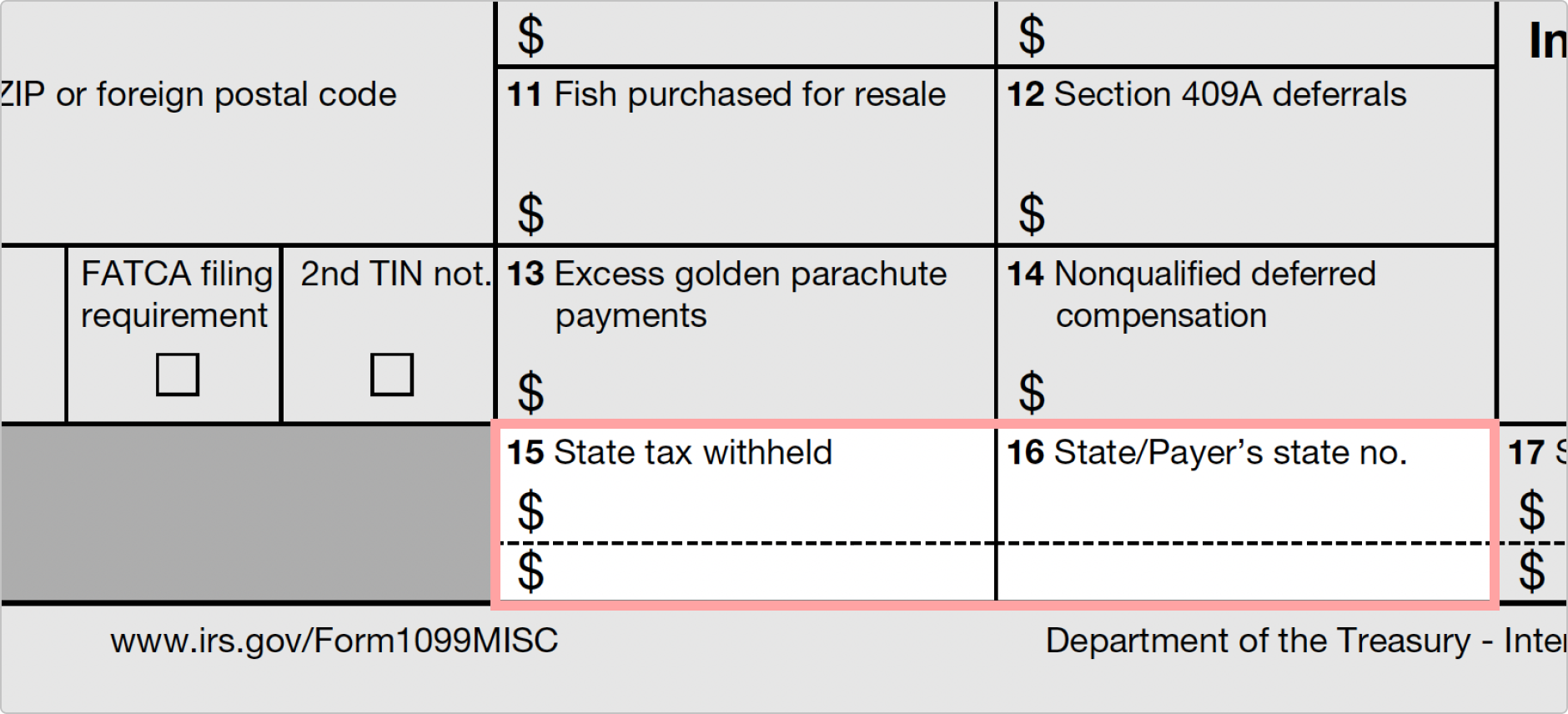

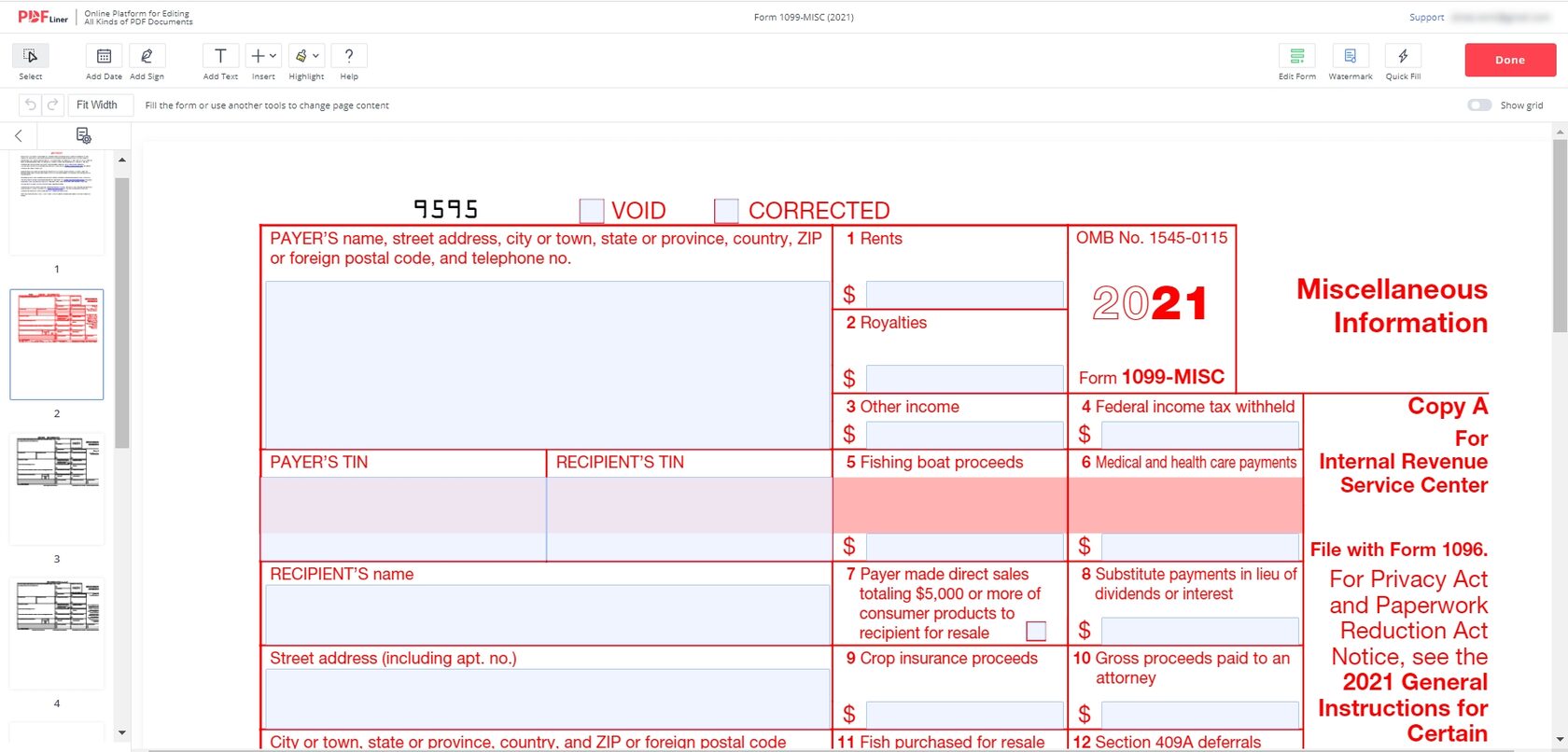

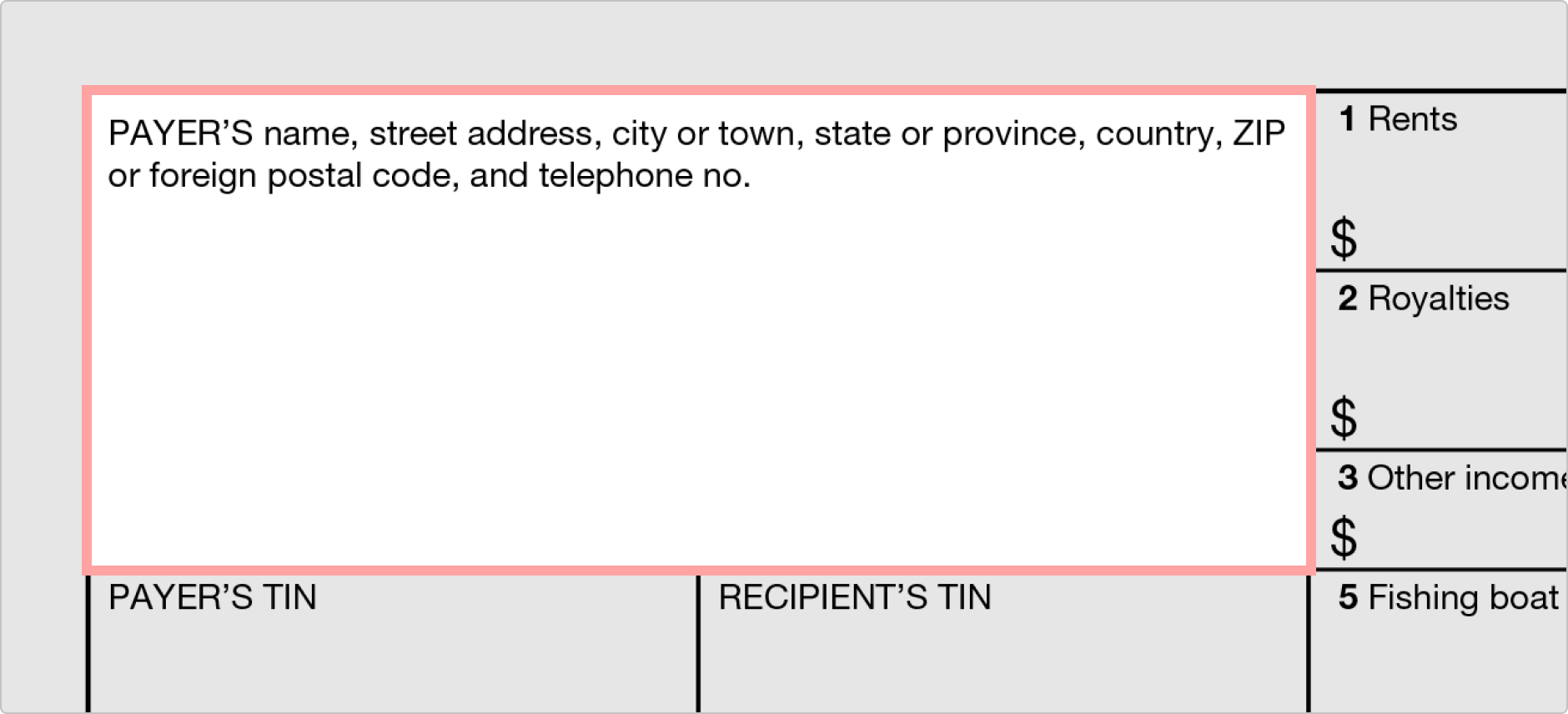

Payers use Form 1099MISC, Miscellaneous Income or Form 1099NEC, Nonemployee Compensation to Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099NEC) Report payments of $10 or more made in the course of a trade or business in gross royalties or payments of $600Independent Contractor shall devote such time, attention and energies as required 5 Independent Contractor is an Independent Contractor and may engage in other business activities provided, however, that Independent Contractor shall not during the term of this Agreement solicit Company's employees or accounts on behalf of1099 form independent contractor Complete forms electronically working with PDF or Word format Make them reusable by generating templates, add and fill out fillable fields Approve documents using a legal electronic signature and share them by using email, fax or print them out download forms on your computer or mobile device

Q Tbn And9gcr A0xynxdhhxxfl7nxp1 Ksov2b3i1bqvj6yqi0itop9kghngk Usqp Cau

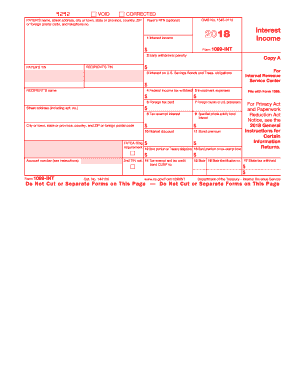

1099 Int 17 Tax Forms Irs Forms 1099 Tax Form

Payer is reporting on this Form 1099 to satisfy its chapter 4 account reporting requirement You also may have a filing requirement See the Instructions for Form 38 Amounts shown may be subject to selfemployment (SE) tax If your net income from selfemployment is $400 or more, you must file a return andBlank Printable W9 – Form W9Request for Taxpayer Identification Number and Certification — is a commonly used IRS form If you have your own business or operate as an independent contractor a client may request that you fill out and mail a W9 so they can precisely prepare the 1099NEC form and report the payments Yes, your contractor can file Copy B 19 Form 1099MISC Instructions Filing date when nonemployee compensation (NEC) payments are reported in box 7 Section 6071(c), requires you to file Form 1099MISC on or before , if you are reporting

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

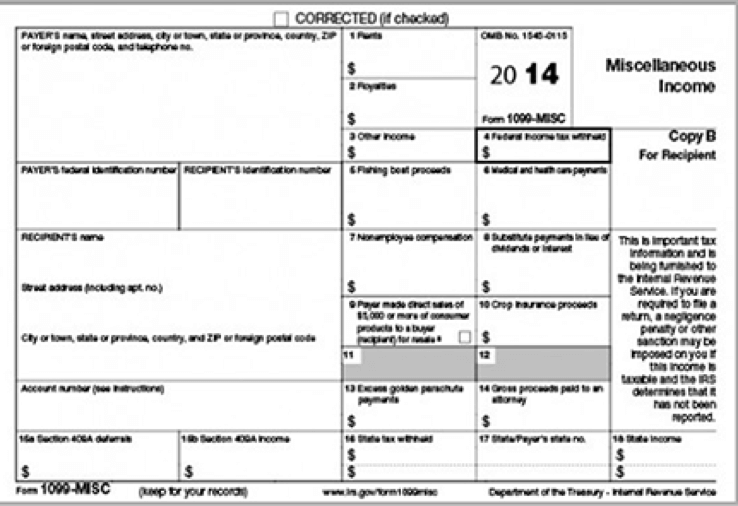

For example, if you give a worker a 1099 Form rather than a W2 Form, they may still be an employee Persons who work for you may qualify as employees under the law, even if, for example You have the person sign a statement claiming to be an independent contractor; Form 1099MISC is the most common type of 1099 form 1099MISC is a variant of IRS Form 1099 used to report taxable income for individuals that are not directly employed by the business entity or individual making the payment For example contractors It can also be used to report royalties, prizes, and award winnings1099 Form Independent Contractor Printable – A 1099 form reports certain kinds of income that tax payers have earned during the year A 1099 form is crucial because it's used to record nonemployment income earned by a taxpayer

Form 1099 Misc Bhcb Pc

Irs Form 1099 Misc Fill Out Printable Pdf Forms Online

Payers use Form 1099MISC, Miscellaneous Income or Form 1099NEC, Nonemployee Compensation to Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099NEC) Report payments of $10 or more made in the course of a trade or business in gross royalties or payments of $600 A 1099 Form is a record that an entity or a person gave or paid you money The main purpose of 1099 Form is to record income paid to an individual during the tax year For example independent contractors receive 1099 MISC Form from their clients The Form reflects the money the client paid to the independent contractor for performing work onThey waive any rights as an employee

1

1099 Nec Form 22 1099 Forms Taxuni

IRS 1099MISC Form – To be filed by the payor of an independent contractor of any individual that was paid more than $10 in royalties, $600 in payments, or $5,000 of a buyer for resale Contractor Work Order – An outlined request that is made prior to a job being assigned that gives a quote of the costs attributed to the labor and materials associated with the work While the income of workers is reported on Form W2 by their employer, independent contractors will collect Forms 1099MISC to report income to the IRS It is a common exchange between independent contractors and their customers To allow this to happen in the first place, the independent contractor must submit a Form W9 so that Read More »Details Form 1099 MISC is a tax form used by the IRS to track all the miscellaneous income paid to the nonemployees (independent contractor) in the course of the trade or business In a simple context, you must file 1099 MISC if you have paid any independent contractor a sum of $600 or more in a year for their services for your business or trade

1099 Form What It Is And How To Complete It Fairygodboss

Printable Irs Form 1099 Misc For 15 For Taxes To Be Filed In 16 Intended For 1099 Template 16 Irs Forms 1099 Tax Form Tax Forms

The most important document you will need to hire freelancers and independent contractors is an Independent Contractor Agreement This outlines the terms of a deal between a client and contractor and makes the agreed terms legally binding It will also be necessary to have an IRS form W9 available when you begin the process of hiring a contractor 1099 Form Independent Contractor Printable – One of the most important and fundamental paperwork you must have at all times is a 1099 form It is a form the IRS demands all companies to maintain It could be used by businesses as an effective method of submitting their annual earnings tax returns In this article I'm going to explain what a 1099 Form is, how you canFor example, if you paid $700 to an independent contractor during the tax year of 18, you have to send out a 1099 MISC to that particular contractor by 31 st Jan, 19, which is the due date This form is most commonly used to pay the freelancers, handymen, independent contractors, or anyone else who provides a service and isn't on your

How To File 1099 Misc For Independent Contractor Checkmark Blog

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

21 Gallery of Printable 1099 Forms For Independent Contractors Irs 1099 Forms For Independent Contractors Free 1099 Forms For Independent Contractors A 1099 is an "information filing form", used to report nonsalary income to the IRS for federal tax purposes There are variants of 1099s, but the most popular is the 1099NEC If you paid an independent contractor more than $600 in a financial year, you'll need to complete a 1099A worker other than an "employee" is usually an independent contractor You must give them a Form 1099NEC for tax purposes These workers negotiate their own compensation as part of a contract with you and may work for a set amount of time, often on a perproject basis

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

Free Independent Contractor Agreement Templates Pdf Word Eforms

Fillable Online Sjsu Independent Contractor Agreement Form Fax Email Print Pdffiller

1099 Misc Form Fillable Printable Download Free Instructions

Do I Need To File 1099s Deb Evans Tax Company

1099 Form Independent Contractor Free

Form 1099 Requirements

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

Free Blank 1099 Form 1099 Form 21 Printable

1099 Software 1099 Printing Software 1099 Efile Software And 1099 Forms Software

Ready For The 1099 Nec Emc Financial Management Resources Llc

Tax 1099 Form 19 1099 Form 21 Printable

W9 Form 21 Printable Payroll Calendar

Form 1099 Nec Instructions And Tax Reporting Guide

Independent Contractor 1099 Invoice Templates Pdf Word Excel

Independent Contractor 1099 Invoice Templates Pdf Word Excel

Free Independent Contractor Agreement Templates Pdf Word Eforms

1

Who Are Independent Contractors And How Can I Get 1099s For Free

Printable Form 1099 Misc 21 Insctuctions What Is 1099 Misc Tax Form

How To File 1099 Misc For Independent Contractor Checkmark Blog

Irs Forms 1099 Int Printable 17 Fill Out And Sign Printable Pdf Template Signnow

Www Idmsinc Com Pdf 1099 Nec Pdf

Irs Form 1099 Reporting For Small Business Owners In

Free Independent Contractor Agreement Pdf Word

Form 1099 Nec For Nonemployee Compensation H R Block

1099 Misc Form Copy B Recipient Zbp Forms

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

21 Irs Form 1099 Simple Instructions Pdf Download

Create An Independent Contractor Agreement Download Print Pdf Word

1099 Form 21 Printable Fillable Blank

W 9 Form Fillable Printable Download Free Instructions

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Form 1099 Nec Instructions And Tax Reporting Guide

What S The Difference Between 1099 And W 2 Printable 1099 Misc Form

1099 Misc Form Fillable Printable Download Free Instructions

1099 Misc Form Fillable Printable Download Free Instructions

1099 Misc Form Fillable Printable Download Free Instructions

1099 Form 19 For Independent Contractors

Instant Form 1099 Generator Create 1099 Easily Form Pros

What Is A 1099 Misc Form And How To Fill Out For Irs Pdfliner

1099 Form Unemployment Ny

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Form 19 Pdf Fillable

Form 1099 Div Box 7d 1099 Form 21 Printable

1099 Misc Form Fillable Printable Download Free Instructions

Get Your 1099 Miscs Right In 5 Easy Steps Cartwheel Technology Solutions For Business

Www Schooltheatre Org Higherlogic System Downloaddocumentfile Ashx Documentfilekey C6a7e1c1 4254 5765 61a8 7621c Forcedialog 0

What Is A 1099 Contractor With Pictures

1099 Misc Form Fillable Printable Download Free Instructions

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

15 Printable 1099 Form Independent Contractor Templates Fillable Samples In Pdf Word To Download Pdffiller

Office Supplies 19 Tops kit 1099 Misc Tax Forms Envelopes Plus 1096 Transmittal 5 Part Office

50 Free Independent Contractor Agreement Forms Templates

Payroll Forms Frequently Asked Questions And Links Office Of The Controller Wright State University

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

1099 Misc 14

Instructions For 1099s 18 Fill Out And Sign Printable Pdf Template Signnow

Who Gets A 1099 Misc What You Need To Know About Contractors Small Business Trends

1099 Form 18 Fill Out And Sign Printable Pdf Template Signnow

1099 Form Independent Contractor Agreement Unique 1099 Form Independent Contractor Agreement Example Forms For Models Form Ideas

Understanding The 1099 Misc Form

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Irs 1099 K 17 Fill And Sign Printable Template Online Us Legal Forms

12 1099 Form Independent Contractor Free To Edit Download Print Cocodoc

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Printable 1099 Form 18 Brilliant 1099 Form Independent Contractor Models Form Ideas

1099 Misc Form Fillable Printable Download Free Instructions

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

:max_bytes(150000):strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Get W 2 Forms And 1099 Misc Forms

Form 1099 Nec Form Pros

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

How To Fill Out And Sign Your W 9 Form Online To Get Paid Faster

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

Form 1099 Misc Miscellaneous Income Definition

1

1099 Form 19 Online Tax Form 1099 Irs All Extensions To Print With Instructions

Independent Contractor 1099 Invoice Templates Pdf Word Excel

1099 08

Free Independent Contractor Agreement Free To Print Save Download

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

0 件のコメント:

コメントを投稿